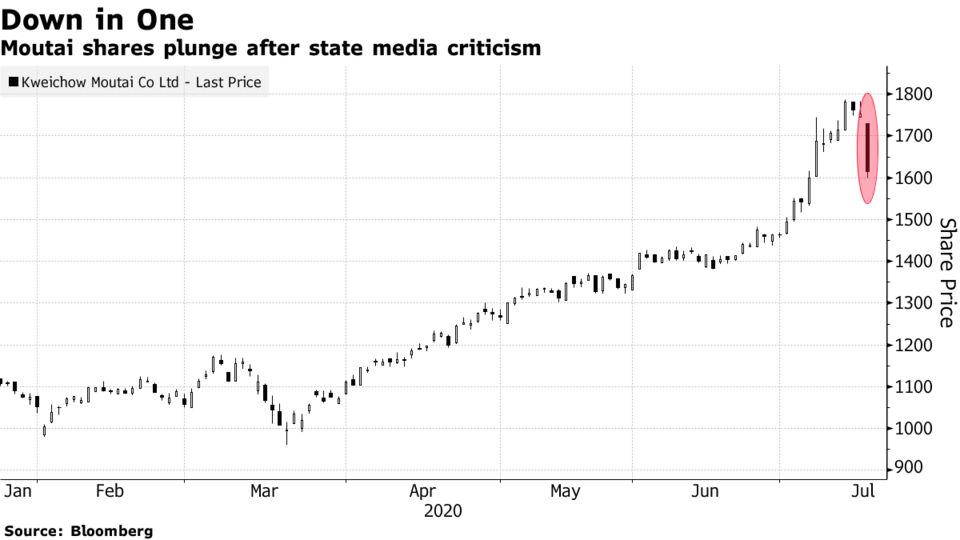

China’s Attack On Its Biggest Stock Wipes Out Record $25 Billion

Updated on

- People’s Daily criticises liquor maker for high prices

- Moutai had risen about 50% this year before Thursday’s plunge

Kweichow Moutai Co. fell the most in nearly two years after the influential People’s Daily took aim at the high price of the liquor it makes, saying the alcohol was often used in corruption cases.

Moutai, China’s biggest domestically listed company, tumbled 7.9% in its worst decline since October 2018, wiping out a record $25 billion of value. Moutai’s products are often involved in the country’s official corruption cases and used for bribery given their high prices, according to a commentary carried by a WeChat account owned by the People’s Daily.

The plunge reverberated across China’s almost $10 trillion stock market, with the SSE 50 Index of the nation’s largest companies sinking 4.6%, its worst decline since early February. Other liquor makers also plummeted, with Wuliangye Yibin Co., Jiangsu Yanghe Brewery Joint-Stock Co. and Luzhou Laojiao Co. all falling by the 10% daily limit.

The comments were seen as the latest efforts by officials to cool sentiment in the nation’s equities after retail investors took on the most amount of leverage in five years to speculate in shares. Targeting Moutai, one the most popular stocks in the country, is also a tried and tested strategy: in 2017, Xinhua News Agency said the stock was rising too fast, triggering a wider selloff.

“Both Moutai shares and its products are hot investment targets, and cracking down on them signals the regulators’ determination to remove froth from the A-share market,” said Zhang Gang, a strategist at Central China Securities Co. “Moutai is such a heavyweight and if this bubble keeps building, the aftermath will be terrible if it burst. Policy makers don’t want to repeat the history of 2015.”

A leverage-fueled bubble five years ago wiped out $5 trillion of capitalization, burnt retail investors and shook confidence in regulatory oversight of the stock market. Officials started taking measures to calm the current rally at the end of last week after the SSE 50 neared its 2015 high, with government-owned funds announcing plans to trim holdings of stocks that had soared.

No comments:

Post a Comment