Beijing says it halted $37bn Ant IPO to protect market stability

Beijing said it suspended the $37bn listing of Ant Group, controlled by China’s richest man Jack Ma, to protect the country’s capital markets as investors reeled from the eleventh-hour decision.

The order to stop Ant from launching a record-breaking IPO in Hong Kong and Shanghai, two days before trading was due to start, is likely to have come from the very top of the Chinese government, potentially from President Xi Jinping himself, according to two people familiar with the situation.

Wang Wenbin, China’s foreign ministry spokesman, said on Wednesday that officials had halted the IPO to “better maintain the stability of the capital markets and to protect investors’ interests”.

Ant’s IPO had created a frenzy in both Hong Kong and Shanghai among both institutional and smaller investors. Bankers working on the IPO in Shanghai said last week that retail bids had exceeded the value of the shares on offer by more than 870 times, equivalent to Rmb19.1tn ($2.8tn).

Behind the scenes, however, Chinese regulators have been steadily tightening control of the country’s booming micro-lending sector, and now have Ant in their crosshairs.

Draft regulations published on Monday, shortly before the IPO was halted, will hurt Ant’s lending business, which was responsible for nearly 40 per cent of its sales in the six months to June.

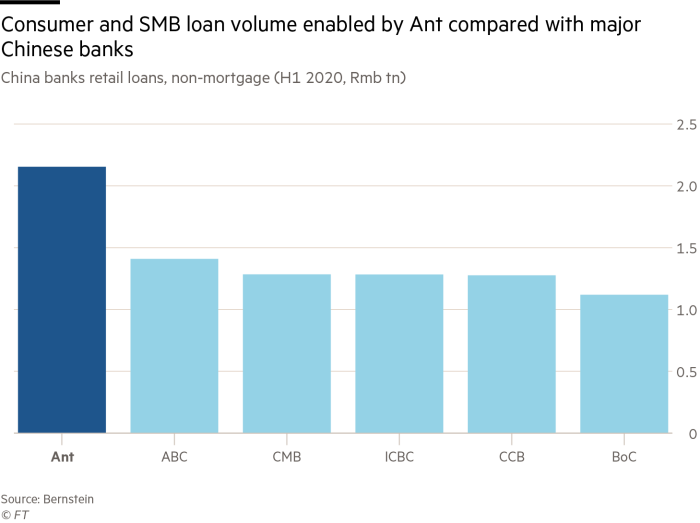

Ant’s credit business is now so huge that it now issues about one-tenth of all of China’s non-mortgage consumer loans, but the vast majority of these are made through its partner banks or packaged as securities and sold on, with only 2 per cent falling on to Ant’s balance sheet.

The draft regulation calls on Ant to provide at least 30 per cent of the funding for loans and to cap loans at Rmb300,000 ($44,843) or a third of a borrower’s annual salary, whichever is lower.

Mr Ma, Ant’s founder, has been lobbying regulators against the proposals, according to two people familiar with the situation, culminating in a speech in Shanghai at the end of October, when he suggested that China’s banks had a “pawnshop mentality” and Ant was an essential part of the credit system.

An Ant Group spokesperson denied Mr Ma had lobbied regulators on the matter: “The claim is baseless and is pure fabrication. Ant Group has made full disclosure of the material risks of our business in the prospectus,” the spokesperson said.

An executive at one of China’s “Big Four” state banks said that while Ant currently had a low level of defaults on its loans, the government was concerned that the figure “could take off in the event of a sharp economic slowdown”.

“That creates social risks the government is keen to avoid,” the banker said, adding that Mr Ma’s open challenge to the regulator in Shanghai had been “unacceptable” and “prompted the regulator to go ahead and announce the new rules”.

“The logic for Beijing is: ‘If I don't understand and can’t control you — I won’t let you grow’,” added the executive.

Rebecca Chua, founder of Hong Kong investment company Premia Partners, said it was “better for the regulators to put constraints” on Ant now rather than expose traders to heavier losses later. “You don’t want retail investors to lose half their fortunes. Jack Ma can afford to — but they can’t.”

Analysts said it was difficult to determine how long Ant’s IPO would be suspended for.

They “will almost certainly return to the market at some point, though the timetable is unclear”, said Andrew Batson, China research director at Gavekal, a research firm. “But the company may well have to make substantial changes to its internal organisation and business model to comply with new regulatory requirements.”

The suspension of the IPO also throws into doubt what would have been a bumper payday for Wall Street investment banks and others working on the deal, which were expected to reap at least $300m in fees.

“The deal would have to complete in order to get paid,” said one Hong Kong-based investment banker who worked on the Ant deal. “It is making everyone very nervous,” added an IPO lawyer in the city.

Daily newsletter

#techFT brings you news, comment and analysis on the big companies, technologies and issues shaping this fastest moving of sectors from specialists based around the world. Click here to get #techFT in your inbox.

Ant has vowed to return cash committed to its IPO by retail investors in Shanghai and Hong Kong — many of whom bought with high levels of leverage. But some suggested it had shaken their faith in investing in China’s markets.

“It’s a big blow to investors’ confidence,” said Gu Qiankun, a 31-year-old investor in Wuhan who had bought 500 Ant shares.

The decision was the biggest blow for China’s private sector since Mr Xi took power in 2012. The Hong Kong-listed shares of Alibaba, which owns about one-third of Ant and relies on its technology to power its payments platforms, fell 8 per cent on Wednesday.

No comments:

Post a Comment