Fall of China’s ‘most profitable’ coal miner is a cautionary tale

Less than a decade ago, Yongcheng Coal and Electricity Holding was one of China’s most celebrated energy companies.

Blessed with ample reserves of high-grade coal at its mines in China’s central Henan province, the nation’s government-controlled banks were eager to hand the firm cheap credit. At its height in 2013, the business’s annual revenue was Rmb127.4bn ($19.5bn).

“We were the most profitable coal mine with the highest salaries in the nation,” said one senior Yongcheng executive, who asked not to be identified, of that period.

A dramatic decline has changed all that. The city of Yongcheng, where the group is based, is today pockmarked with half-built and dilapidated buildings. Struggling workers at the company, many of whom have not been paid for months, have taken to packing and selling flour to make ends meet.

But Yongcheng’s woes did not take on national significance until last month, when the company defaulted on bonds worth Rmb3bn.

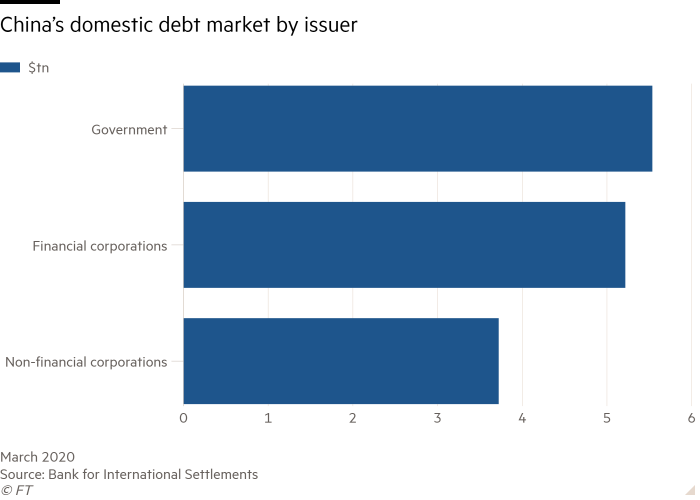

That development disturbed China’s $15tn public debt market, the world’s second-biggest, and kicked off a spate of defaults at other local government-controlled businesses, which account for a big chunk of the country’s economy.

The defaults have ricocheted through China’s financial system. Analysts say that state-linked companies now face difficulties raising capital as a result. The episode has also obliterated longstanding investor assumptions that authorities will always bail out state-owned enterprises in China.

A lot more defaults could be in the pipeline

“The biggest impact has been on other state-owned issuers,” said Chen Long at Plenum, a Beijing-based consultancy. “SOEs from Henan haven’t been able to issue any bonds in the last few weeks. The longer that their companies are not able to issue bonds, the bigger the problem will grow.”

Some think that Yongcheng’s difficulties could be a harbinger for problems at other state-linked groups across China. “Yongcheng’s business failure could happen to any state-owned enterprise with weak fundamentals,” added a Beijing-based investor that bought the company’s bonds. “A lot more defaults could be in the pipeline.”

In the case of Yongcheng, the group’s downfall was sown by the financial unravelling of its parent company, Henan Energy and Chemical Group. HECG forced the coal miner to issue increasingly pricier bonds and borrow from China’s less regulated shadow bank sector at a time when the overall credit environment was tightening.

That transformed Yongcheng from what its bankers regarded as a low-risk borrower into a much riskier proposition with a myriad of creditors.

The woes for Yongcheng and its parent can be traced back to more than a decade ago when the latter launched an ill-fated expansion into coal-derived chemicals.

The venture earned HECG a spot on 2011’s Fortune 500 list of the world’s biggest companies, prompting the Henan provincial government to call a press conference to celebrate the milestone.

HECG aimed to become “a world class coal company”, Chen Xiang'en, the group’s president at the time, said of its pivot to high-end chemical products, which would eventually cause heavy losses for the company.

Prices of ethylene glycol, one of HECG’s biggest chemical products, have fallen by almost two-thirds since the group began manufacturing it in 2011 because of a supply glut, with little respite on the horizon. “China’s coal chemical industry is facing an oversupply that could take many years to ease,” said Qi Dan, an analyst at Baiinfo, a consultancy.

Twice weekly newsletter

Energy is the world’s indispensable business and Energy Source is its newsletter. Every Tuesday and Thursday, direct to your inbox, Energy Source brings you essential news, forward-thinking analysis and insider intelligence. Sign up here.

As its troubles in the chemical market deepened, HECG struggled to service its bank loans. As a result, it turned to China’s nascent bond market, where it has raised Rmb60bn ($9.1bn) over the past five years, according to public records.

“We paid a price for expanding our footprint without taking into account profitability,” said one senior manager at HECG.

In an attempt to shore up its finances, HECG began pressing Yongcheng, its best-performing subsidiary, to tap bond markets. Yongcheng has raised Rmb66bn in debt since 2018, typically paying investors interest of about 6 per cent.

But Yongcheng also turned to more expensive trust loans — off-balance sheet lending by banks and other financial institutions — with interest rates ranging between 6.5 and 7.5 per cent. According to people directly familiar with Yongcheng’s fundraising activities, a significant portion of its bond and trust loan proceeds were used to pay off HECG’s debts.

Yongcheng was not forthcoming with its investors about this, often telling them that it was raising cash to replenish working capital or pay down its own debt. China’s National Association of Financial Market Institutional Investors, a regulatory body, last month accused four of Yongcheng’s bond underwriters, its auditor, a rating agency and HECG of breaking capital market rules. Yongcheng and HECG declined to comment.

Some Yongcheng creditors say they knew the miner was propping up HECG, but assumed Henan’s provincial government would stand behind both companies because of their strategic importance to the local economy, which thrives on exports of coal and flour. But they did not anticipate the Covid-19 pandemic, which has slammed many regional governments’ finances.

“We knew HECG was dragging Yongcheng down,” said one investor. “But HECG is the biggest SOE in Henan and the provincial government can’t afford to let it go under.”

Hopes of a full bailout from Henan are fading as the provincial government struggles with its own growing fiscal deficit.

Two Yongcheng bondholders told the Financial Times that HECG assured them early in November that the local government would inject Rmb15bn into the group to resolve its debt problem. But less than half of that sum has arrived, according to people with direct knowledge of the situation. “We maintained faith in government backing until the last moment” before the default, one of the investors said.

Since Yongcheng’s default, more than 260 SOEs have suspended bond issues. Those that have gone ahead are having to pay higher interest rates.

“Now that government guarantees are gone, underperforming SOEs must pay higher interest or they won’t gain access to the credit markets,” said the head of credit ratings at a Beijing-based bond investor.

For many employees who are enduring hardship as a result of the company’s difficulties, Yongcheng’s fall has been a humbling experience.

“Ten years ago I could earn Rmb12,000 a month when my friends at other companies made less than Rmb2,000,” said one Yongcheng engineer who has been with the company for 15 years, but has not been paid for six months.

He is now selling flour to sustain a living. “Now I must live without a salary for half a year and there is no update on when my next pay cheque will arrive.”

No comments:

Post a Comment