A $4.5 Billion Chip Deal Shows Dark Side of the Boom

GlobalWafers is paying 100 times last year’s free cash flow for a slowing business in an underperforming sector.

A decision by Taiwan’s GlobalWafers Co. to buy its German rival Siltronic AG marks an expensive bet on consolidation that exposes the stark reality of their slice of the semiconductor market. For the seller, it’s the best deal they could have hoped for.

GlobalWafers agreed to a tender bid that values the target at 3.75 billion euros ($4.5 billion). Unsurprisingly, Siltronic’s major shareholder Wacker Chemie AG is delighted and has agreed to sell its 31% stake. It knows it won’t get a better offer.

That’s because at 125 euros per share, Siltronic is being bought for almost 25 times this year’s projected earnings. In other words, assuming constant income, it would take a quarter of a century to earn that money back. The only way that GlobalWafers could justify the deal is if there’s a real prospect that the merger will boost earnings through revenue growth or cost cuts. Neither is likely. The target company expects earnings per share to be “significantly below prior year” in 2020.

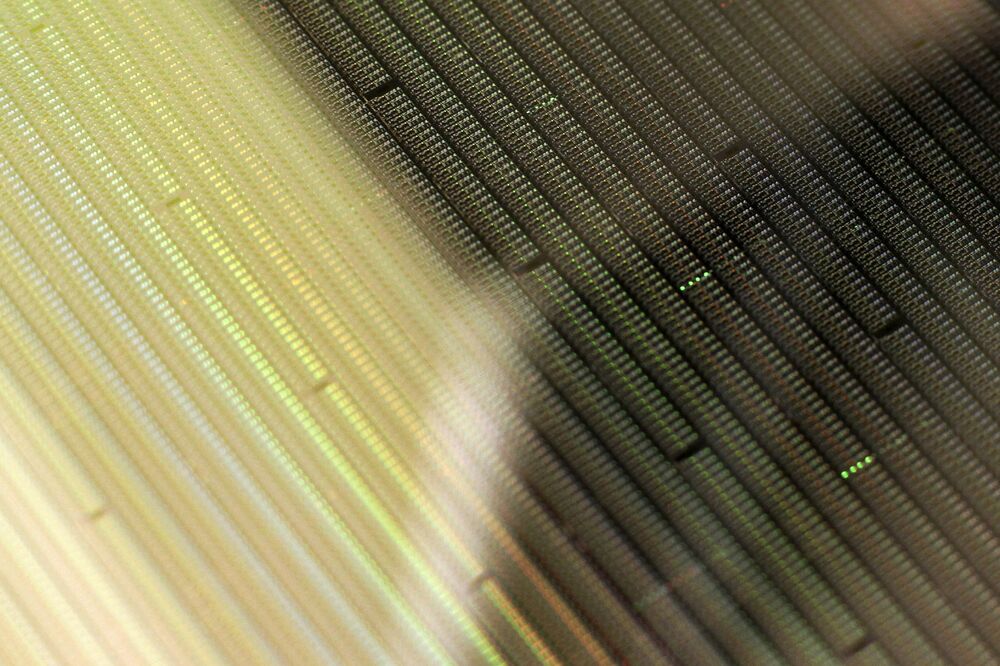

These companies are in the important but mundane business of making and cutting silicon ingots into the thin slices upon which semiconductors are made. Their specific slice of the chip market is underperforming the rest. What’s worse, Siltronic has been a laggard, growing more slowly than the broader wafer market.

Tepid, at Best

Siltronic's growth has lagged its peers, and the sector itself has underperformed the broader chip market

Source: SEMI, Bloomberg, WSTS

ccording to industry group SEMI, global wafer shipments will climb 2.4% this year and 5% next. By contrast, broader chip demand will expand by 5.1% and 8% respectively, Worldwide Semiconductor Trade Statistics Inc. projects. This disparity is explained by technological advances, with manufacturers like Taiwan Semiconductor Manufacturing Co. and Samsung Electronics Co. able to shrink chips and cram more onto each wafer. Great news for smartphone makers and consumers, terrible for those that make the wafers.

So that means strong industry growth is unlikely to be a driver. However, the merger will create a supplier with around one-third of global silicon wafer revenue. If it is to boost sales, beyond what the combination creates, then it can probably only do so with the pricing power that comes with size. But one-third of the market may not be enough, and using that power would create enormous antitrust risks.

That leaves cost cuts as the other chief way to juice the bottom line. Yet GlobalWafers said it will keep all Siltronic staff until the end of 2024. Ouch! Perhaps Chairwoman Doris Hsu remembers that infamous moment in Taiwan M&A history: the BenQ-Siemens debacle of 2005, which saw the Taipei-based electronics maker get stuck with thousands of Siemens AG staff it couldn’t lay off due to German labor laws.

There may be some wiggle room for the merged business to squeeze better pricing out of suppliers. Even so, that hardly justifies a 48% premium to the 90-day average price of Siltronic shares prior to the first disclosure of this deal two weeks ago.

Funding is also a worry. GlobalWafers will pay in cash through financing arranged by DBS Group Holdings Ltd. Siltronic had just 36.3 million euros in free cash flow last year — barely 1% of the acquisition price — and has said it expects net cash flow to decline this year. Further, GlobalWafers has committed to “ensuring adequate capex to support existing wafer production lines.” So the takeover could be a real drain on the buyer with limited benefit to revenue, or cash.

The world may well be experiencing booming demand for the chips that power our digital lives. But every now and then a deal comes along that exposes the disparities in this global industry. GlobalWafers’ purchase of Siltronic shows that not all semiconductor suppliers are created equal.

No comments:

Post a Comment