Investors fear buoyant global markets vulnerable to China credit crunch

Short-term lending rates spiked in January, fanning fears Chinese policymakers would tighten policy

- Email icon

- Facebook icon

- Twitter icon

- Linkedin icon

- Flipboard icon

- Print icon

- Resize icon

Investors warn the cheery mood in global stock and commodity markets could come to an unfortunate end if Chinese policymakers constrict lending to prevent the country’s economy and financial markets from overheating.

Money managers are all too aware that more restrictive borrowing in the world’s second largest economy can have reverberations across the globe.

“Given China’s influence within the emerging markets, pre-mature or pre-emptive tightening of monetary policy poses a risk to financial stability in China, Asia and the broader emerging markets spectrum,” said Brendan McKenna, an international economist at Wells Fargo, in a Monday note.

Analysts have pointed out that some Chinese credit growth metrics have rolled over at the turn of the year. Those brought up haunting memories for traders who watched global markets crumble at the end of 2015 around when credit growth stalled.

In a highly indebted economy expected to grow by a high single-digit percentage this year, an unexpected tightening of China’s credit spigots could take the gloss off those rosy forecasts.

Indeed, bond fund manager Pimco warned one of the biggest risks to their mostly upbeat forecasts on the global economy’s trajectory was excessive tightening from Chinese monetary policymakers.

Pimco fretted that, in its efforts to fine-tune financial conditions in an economy with elevated levels of debt among households, businesses and local governments, Beijing could end up overtightening.

In the past few months, senior officials from the People’s Bank of China including its governor Yi Gang have suggested the central bank would calibrate lending to keep the recovery going without endangering the country’s financial stability.

Yet concerns around the latter appeared to win out after PBOC adviser Ma Jun warned last week the risk of asset bubbles would rise if the central bank did not tweak policy this year.

Today's Insights. Tomorrow's Implications.

Jun’s comments hinted at the growing pressure on the central bank to change tack, after PBOC kept policy loose throughout last year to support the recovery from the depths of a pandemic that had originated from China.

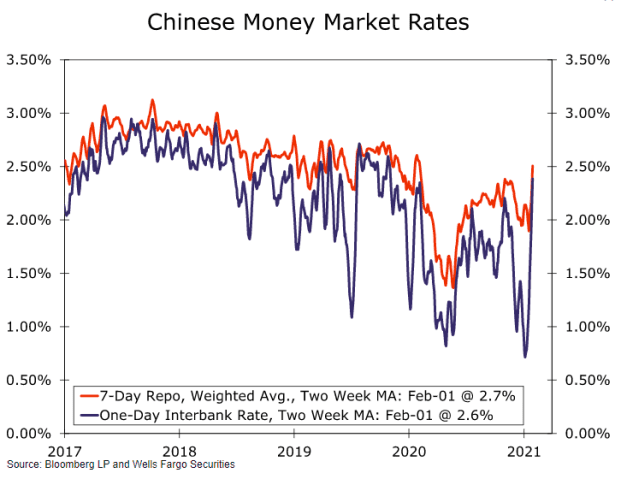

Last week, the central bank withdrew liquidity from the financial system, sending the one-day lending rate between banks to a more-than-one-year-high of 2.8% last week.

The spike in lending rates spilled over into the rest of China’s markets. Last week, the Shanghai Composite index CN:SHCOMP fell 3.5%, while the 2-year Chinese government bond yield rose 18 basis points.

Traders feared liquidity support from the PBOC would not be forthcoming before Chinese New Year, a time when the central bank has traditionally injected cash into money markets to satisfy the heightened consumer spending and demand for cash that comes with the long holiday period.

But Yan Wang, chief emerging market and China strategist at Alpine Macro, cautioned reading too deeply into moves in short-term lending rates.

In his view, money market rates were too turbulent to offer clear clues on where the central bank stood on monetary policy.

Wang argued it was more important to watch what might trigger excessive tightening, namely intensifying inflation pressures, a red-hot real estate market and unfettered shadow lending. On all those counts, the central bank was unlikely to spark another credit crunch.

“The provisions for tightening are not there,” said Wang.

No comments:

Post a Comment