Yellen needs to tell Asian nations to stop currency manipulation

Be the first to know about every new Coronavirus story

The writer is FX strategist at Moore Capital Management

For more than 20 years, roughly a dozen Asian central banks, including those of China and Japan, have intervened to suppress the value of their currencies.

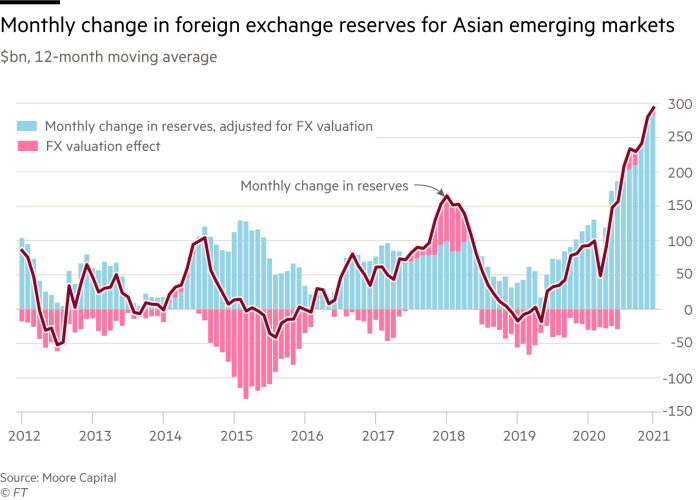

The foreign exchange reserves held by a dozen Asian nations now total more than $6.5tn. In 2020 alone, they increased by approximately $500bn as these countries sought to mitigate the economic impact of the pandemic.

Given the need for sustained stimulus in the US (and the entire western world), the new US Treasury secretary Janet Yellen should make it clear that currency manipulation will no longer be tolerated.

In a time of global crisis, the persistent excess savings of the Asian nations need to be drawn down to help stimulate global growth — otherwise why were they accumulating these reserves other than for “beggar thy neighbour” purposes?

Stronger currencies would boost Asian imports, and instead of intervention monies going into our overpriced bond market, capital investment at the margin would tend to flow to the US, not Asia.

Over the years, the US Treasury has tried to throw sand in the gears of this intervention through the semi-annual publication of a report on the foreign exchange policies of major trading partners. This, arguably, has had some success in slowing the pace of intervention, but it has not stopped it.

The combined annual GDP of the countries involved is some $26tn, larger than that of the US.

As a group, if their excess savings were reduced by 2 per cent of GDP, it would provide the rest of the world with an annual boost of $500bn. Given the US share of non-Asian global GDP, that would represent a $300bn addition to growth in the US, or roughly 1.5 per cent of GDP. The positive impact would not just be one off. Currency movements, especially if they seem likely to persist, do impact business investment decisions and therefore future job growth.

Some might argue that such a shift would be an ugly “America first” move, but that is too harsh. Economically, Asia has weathered the pandemic much better than the rest of the world. Asia has room to “spend” some of this excess savings now. Drawing down the collective current account by only 2 per cent of GDP would still leave most with a positive balance.

China will argue that it is not intervening. It is doing that though, but just disguising it better than before. The renminbi is being supported by a large current account surplus, direct investment inflows, relatively high interest rates and capital market inflows thanks to being included in a variety of stock and bond indices.

Japan will also argue it is not intervening. The Ministry of Finance is not, but the Government Pension Investment Fund is. The GPIF switched almost $100bn out of Japanese government bonds into unhedged foreign bonds in the first three quarters of 2020, even as the costs of hedging for six months have collapsed to only a day’s trading range in the dollar/yen rate.

Its whole overseas investment programme under Abenomics, and its timing, has been in part designed to help weaken the yen. Initially, this aspect of Abenomics was probably a good thing for the world but, after eight years, Japan has had its turn at trying to reflate at the expense of others. The real trade weighted yen is now as weak as just before the Plaza Accord, and Japan’s current account surplus is almost as large.

The Treasury secretary would probably begin such a policy change in private conversation. Perhaps all the countries would then see the wisdom of now allowing their currencies to appreciate and their excess savings rate to fall. If not, over the past decade or so, there is clear evidence that sanctions do work in changing both government and private sector behaviour.

Unlike many historical moments when a new Treasury secretary has been sworn in, the US does not need additional intervention money recycled into its bond market. Yellen should call on countries to stop intervening and let the market determine the price of their currency. Importantly, such a move would not undermine the successful legacy of previous Democratic administrations that understood the value of having a sound dollar.

President Joe Biden has called for unity with domestic partners to deal with fallout from the virus and inequality in the economy. Shouldn’t the Treasury secretary, who is the spokesperson for foreign partnership in economic affairs, ask for the same unity of purpose in the international sphere?

No comments:

Post a Comment