Ex-PBOC Official Warns of ‘Huge’ Losses With Monetary Tightening

- Sheng Songcheng says policy tightening can’t curb bubbles

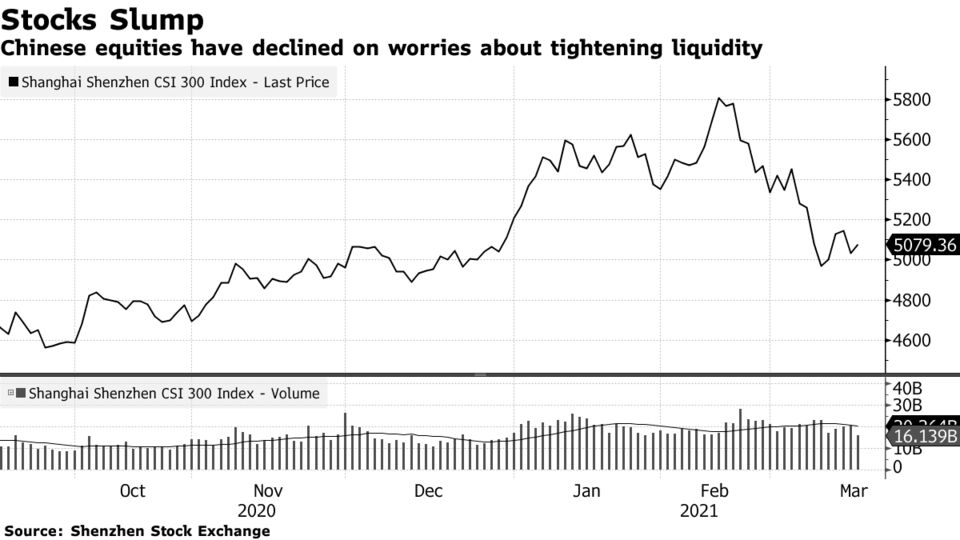

- Debate over central bank’s policy has roiled financial markets

China will risk “huge economic losses” if it tries to curb asset bubbles through monetary policy tightening, a former central bank official warned, adding to a debate that’s roiled financial markets this year.

Sheng Songcheng, a former director of the People’s Bank of China’s statistics and analysis department, said closer market supervision would be better than policy tightening measures to reduce speculation in financial assets.

Investors are watching closely for signs the PBOC will tighten liquidity this year, with a senior official at the bank fueling a market selloff in January by calling for monetary tightening to curb bubbles in property and equity markets. Guo Shuqing, head of the country’s banking regulator and the Communist Party’s top official at the PBOC, issued a warning on global bubble risks this month, which investors interpreted as a signal of future interest rate increases.

Sheng’s comments were a sharp contrast to those views. He said in a written response to questions from Bloomberg News that “tightening monetary policy cannot effectively prevent asset bubbles, but will puncture the bubbles and bring huge economic losses.”

The former central banker pointed to a range of policies rolled out in Chinese cities to control property price increases -- from raising deposit rates to limiting buyers to a single home -- that could be used to curb financial market speculation.

Sheng, who is now a professor at the China Europe International Business School in Shanghai, said monetary policy shouldn’t tighten in the near term in part because China’s investment and consumption growth rates have not fully recovered from the pandemic.

Stronger Currency

With other major economies still relying on loose monetary policy to revive economic growth, tightening by the PBOC will cause a large influx of speculative funds -- which in turn would push up the yuan and weaken the competitiveness of export enterprises, and may also cause imported inflation and asset bubbles, he said.

To reduce appreciation pressure on the currency, Beijing has been signaling a gradual reduction in controls on capital outflows. China’s foreign exchange administration said last month it was considering allowing residents to invest in overseas securities, while the PBOC said last week it would allow select companies to trade foreign currency more easily.

Sheng said Beijing should loosen limits on outbound business investment, such as mergers and acquisitions, to create more outflows and “encourage Chinese enterprises to ‘go global’ and invest in advanced technologies, resources and energy.” China introduced heavy restrictions on overseas investment in 2016 because of capital flight worries, causing the annual value of outbound deals to plummet.

Deleveraging Risk

The PBOC has listed stabilizing the total amount of debt in China’s economy relative to its size, known as the macro-leverage ratio, as one of its goals for this year. But bank officials shouldn’t target the ratio when setting policy rates, Sheng said.

“The macro-leverage ratio is not a reasonable aim for monetary policy,” and leverage will fall “naturally” as economic growth picks up, he said.

“The main problem China has faced is how to deleverage structurally,” Sheng said. “In the structure of stock debt, the debts of state-owned enterprises and local governments account for a large proportion, impairing the efficiency of China’s economy,” he added, advocating the further removal of government guarantees of bail-outs for SOEs with liquidity problems.

No comments:

Post a Comment