Another excellent piece, if I may, from Shuli Ren at Bloomberg. It will be one of humanity's most tragic and catastrophic events that the CCP, having raised the living conditions of many of its subjects (can't say "citizens" because they're not free, and can't say "people" because there are only human beings, not "peoples") in its ruthless pursuit of its Will to Power ( I believe the Nietzschean allusion is eminently appropriate), will now, for that very reason, lead those subjects to their cataclysmic obliteration, to misery and pain not seen for aeons.

Yet it is for the sake of humanity - indeed, for this very reason! - that the CCP must be vanquished completely, its Will to Power extinguished forever.

Don’t Bother Investing in China Unless You’re Chinese

Only a local can properly circumvent the country’s infamous firewall. Even asset managers in Hong Kong no longer have a clear picture of the mainland.

It’s getting harder to see what’s really happening in the economy.

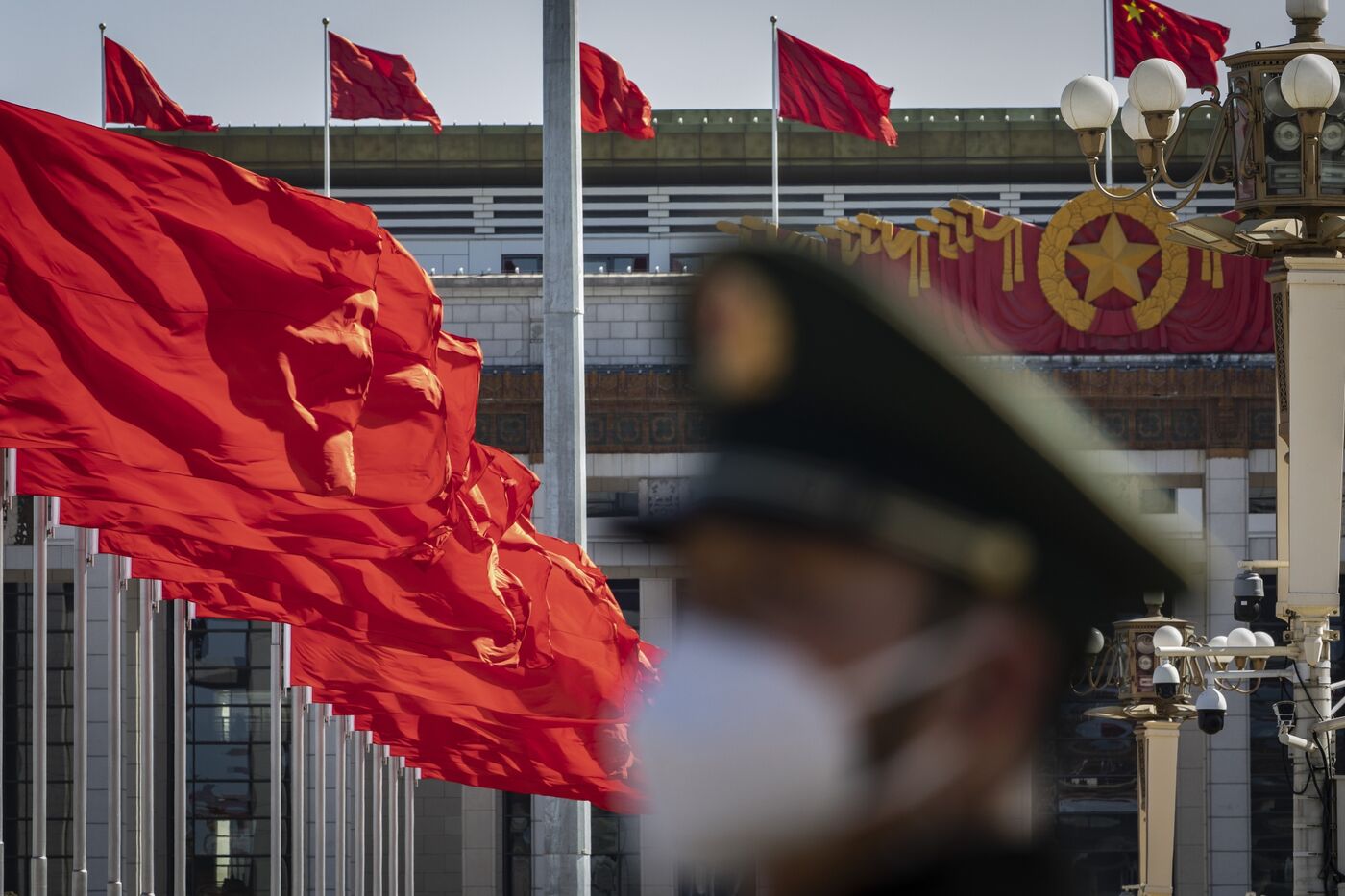

Photographer: Qilai Shen/BloombergIt did not happen overnight. For some time, China has steadily created a tightly sealed vault for its economy, cutting off international access to various databases involving corporate registration, patents and even official statistical yearbooks.

The latest to raise eyebrows is Shanghai-based Wind Information Co., a data platform widely used by traders. In recent days, many foreign think tanks and research firms have found they can’t renew subscriptions to Wind because of “compliance” issues, The Wall Street Journal reported.

One can see why Beijing is feeling sensitive. Apart from real-time financial information, Wind also maintains comprehensive databases on the economy, making it convenient for those who want to study just how dire China’s municipal financing is, or the true state of its industrial sector.

So what does this mean for global asset managers who are still looking to invest in the world’s second-largest economy?

First, so far, this move seems limited to non-financial entities such as non-profit policy research outlets. Wind’s move to cut their access is in response to an expanded anti-espionage law passed by China’s legislature last week. Given the government has been vowing in recent months to open up no matter how the geopolitical situation evolves, it is not a good look to stop selling data terminals to foreign investors now. China may not want that valuable information to end up in the wrong hands — the explanation can be as simple as that.

Second, where there is a will, there is a way. Even if China expands its list of non-compliant entities, a good analyst can still get what she needs. For instance, one can buy Wind’s data series very cheaply on the mainland’s e-commerce channels. After all, the country has a vast underground economy. If people can sell fake Gucci bags online, they can offer to download Wind data for you for a few bucks as well.

That said, it has become increasingly difficult for people offshore, even those of us living in Hong Kong, to find out what China or its companies are up to.

Consider information as irrelevant to national security as company ownership. As recently as mid-2022, those abroad could still use the mainland’s corporate registration databases, such as Tianyancha or Qichacha, to find out the true beneficiaries of a firm’s shareholdings. We no longer can, even though in this case, foreign investors’ interests are aligned with the regulators, which have been asking corporates to disclose more on their shareholders, especially in the financial services industry.

It is troubling, even for those who try to steer clear of geopolitics. Take the real estate sector, a solidly domestic play. Joint-venture projects are common in China, in part because land prices are high. But before buying developers’ dollar bonds, investors must figure out who these joint-venture partners are. Are they genuine businesses that want to share the lofty initial capital outlay, or related parties that exist only to help pretty up builders’ financial metrics? These days, to answer this very simple and legitimate question, Hong Kong-based analysts without onshore research support may have to make a trip across the border to Shenzhen just to figure out on Tianyancha who’s hiding behind layers of shareholding structures.

This goes to my final point. With China getting more secretive, don’t bother investing there unless you have a team of trusted analysts who are native Chinese. They can hustle and circumvent the great China firewall for you, although this comes at great personal risk.

It also explains why many long-only global funds have been sitting on the sidelines despite China’s grand reopening late last year. They know an information black box cuts both ways — it is an edge for some and a disadvantage for others. And it shows that investing in China from thousands of miles away is increasingly a losing trade.

No comments:

Post a Comment