Here are four reasons the West is headed for a ‘very drastic crisis,’ according to a veteran economist

The party can't last forever, says senior economics adviser at French bank Natixis.

KARIM SAHIB/AGENCE FRANCE-PRESSE/GETTY IMAGES- Email icon

- Facebook icon

- Twitter icon

- Linkedin icon

- Flipboard icon

- Print icon

- Resize icon

Markets seem to be in cruise-control mode, at least until the Jackson Hole gathering of central bankers at which the Federal Reserve may finally announce it will slow the rate of bond purchases. The S&P 500 SPX,

Patrick Artus, a senior economics adviser at French bank Natixis and a professor at the Paris School of Economics, isn’t sharing in the joy. In a very blunt memo to clients, Artus says a crisis is “inevitable.”

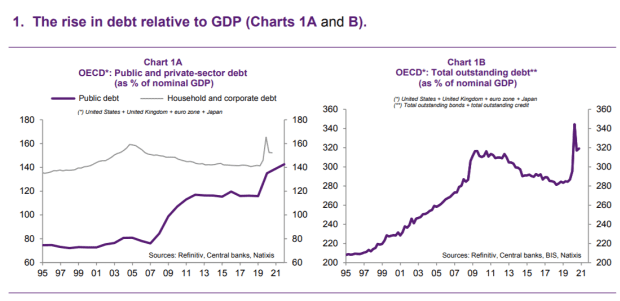

The total outstanding debt of the U.S., the U.K., the eurozone and Japan relative to gross domestic product has come off the highest levels of the pandemic as economies have reopened but still is at elevated levels. “Borrower solvency cannot be ensured if debt-to-income ratios increase continuously,” he says.

The money supply also is at records. “The money supply cannot be increased continuously relative to income, as soon or later demand for money, which is linked to savings and income, can no longer increase,” said Artus, whose résumé includes stints at the Organization for Economic Cooperation and Development and the Banque de France.

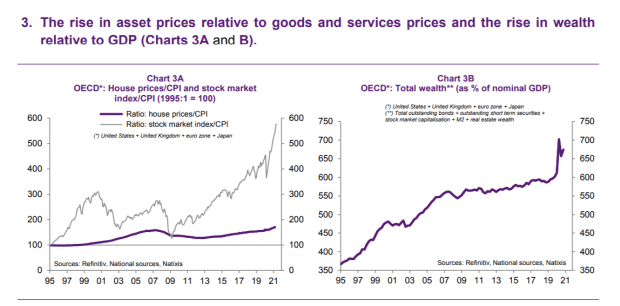

Also zooming higher is wealth, with both stock and housing prices surging. “Rising relative asset prices cannot be extrapolated: If they become too high, the savings of asset buyers will no longer suffice to buy then, leading inevitably to a downward correction in prices,” he says. Finally, he notes a skewing of income distribution against wage earners: “If wage earnings do not receive productivity gains over a long period, demand for goods and services will become too weak to absorb production, which grows rapidly when earnings are invested.”

So how will this unwind? Artus says a correction in income distribution will lead to faster wage growth and higher inflation. That, in turn, will need to more restrictive monetary policy and higher inflation-adjusted interest rates. The more restrictive monetary policy will then stabilize asset prices and wealth, forcing deleveraging. And that deleveraging will lead to a recession due to the necessary fall in demand among households, companies and governments.

“The stabilization of these variables will lead to a very drastic crisis, due to faster growth in wages and inflation, a restrictive monetary policy, a fall in wealth and asset prices, and a recession caused by a fall in domestic demand,” he concludes.

No comments:

Post a Comment