These AAA-Rated Bonds Are Tumbling as China Default Fears Spread

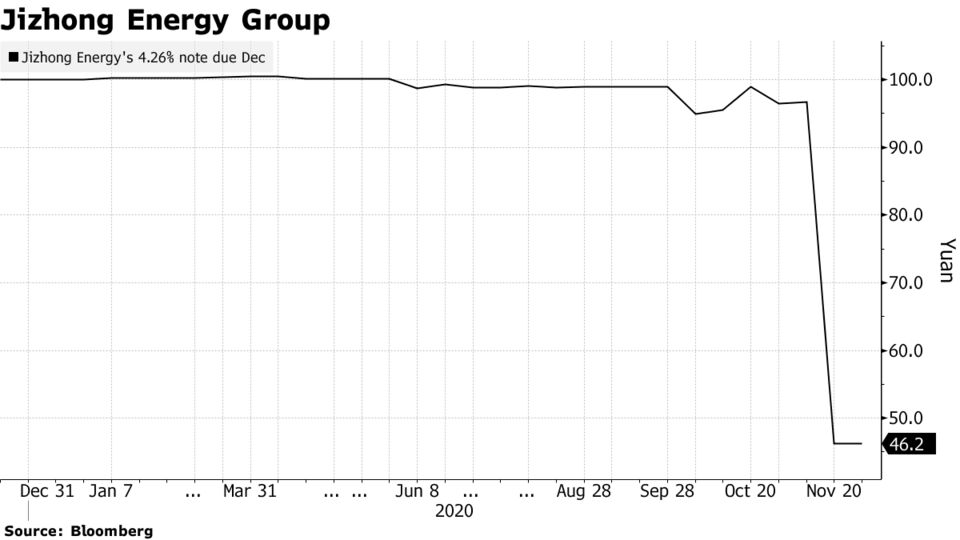

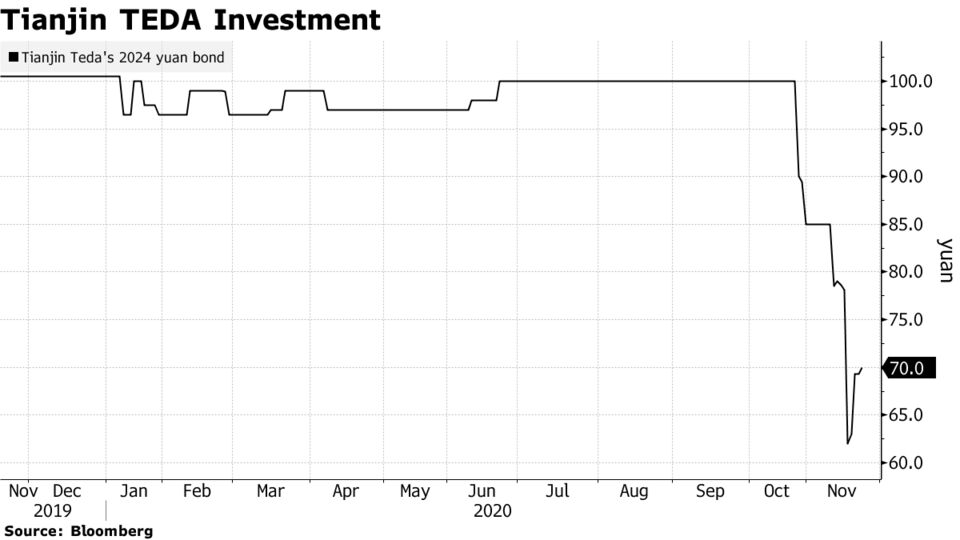

- Jizhong Energy, Tianjin TEDA among hardest-hit state firms

- Such SOE’s debt has risen faster than profits: Pacific Sec.

A string of defaults by Chinese state-owned companies has sent shockwaves across the world’s second-largest credit market.

But some bonds have fared much worse than others as investors clamber to avoid the next potential blowup. Among the most notable losers: notes issued by Pingdingshan Tianan Coal Mining Co., Jizhong Energy Group Co., Tianjin TEDA Investment Holding Co. and Yunnan Health & Culture Tourism Holding Group.

While none of the companies have missed debt payments, and all four are rated AAA by Chinese domestic ratings firms, their bonds have tumbled by at least 14% since Nov. 10. That’s when a surprise default by a state-owned Chinese coal producer cast fresh doubt on the implicit guarantees that have long underpinned government-backed borrowers.

“Most of the onshore bonds hit hardest this time share a common symptom: their profitability has lagged far behind their debt growth,” said Li Yunfei, credit analyst at Pacific Securities Co. “Repricing of some onshore bonds, though it occurred abruptly and quickly, is a rational outcome of the recent defaults.”

Pingdingshan Tianan Coal said in a written reply to Bloomberg News that the company was aware of declines in some of its bonds, but declined to comment further. An official in charge of information disclosure from Yunnan Health & Culture Tourism didn’t answer calls or respond to an an email seeking comment.

An official in charge of Tianjin Teda Investment’s bond issuance department declined to comment when reached by phone. Multiple calls made to Jizhong Energy’s general line were not answered.

Here’s why some investors are worried:

Two days after Yongcheng Coal & Electricity Holding Group Co.’s default on Nov. 10, Pingdingshan Tianan Coal held a meeting to assuage investor concerns following a bond slump. It later wired funds to meet early redemptions on a 500 million yuan ($76 million) bond.

But investors remain cautious about its liquidity. The company’s so-called “quick ratio,” which measures its abilities to use liquid assets to meet short-term debt obligations, fell to 0.6 at the end of September from 0.69 a year ago, according to Bloomberg data. A quick ratio of 1 or above is typically considered healthy.

Jizhong Energy, the top state-run coal producer in Hebei province, suffered its eighth consecutive year of net losses last year. Its total debt, the majority of which carries short-term maturities, surged by 102% to 165.7 billion yuan between 2012 and 2019, according to Bloomberg data. Its quick ratio dropped to 0.48 at the end of June from 0.57 a year ago.

The company has 31.7 billion yuan of bond repayments due by the end of 2021, Bloomberg data show.

Tianjin TEDA Investment, a local government financing vehicle from the northern port city, also faces funding pressure. Its quick ratio was 0.49 at the end of June, compared with 0.46 at the end of 2019, Bloomberg data show. It faces 17.6 billion yuan of bond repayments by the end of 2021. In September, Caixin magazine reported that the Tianjin municipal government held a meeting with various local financial institutions to discuss how to support the indebted firm.

Yunnan Health & Culture Tourism, an LGFV from the southern Yunnan province that is being transformed to focus on cultural tourism and health services from infrastructure building, is awaiting further injection of state capital after having received 16 billion yuan as of the end of October.

Fitch Ratings downgraded it to BBB- from BBB amid signs of uncertainties over the firm’s future ownership in late March, before withdrawing its ratings shortly after, citing “insufficient information”.

China Lianhe Credit Rating Co. maintained its AAA rating on the firm in October. The LGFV’s quick ratio dropped to 0.24 at the end of September, the lowest since 2016, Bloomberg data show.

No comments:

Post a Comment