China's $6 Trillion Stock Wipeout Exposes Deeper Problems for Xi

It’s a public reminder that confidence in the Chinese economy is at its lowest ebb in decades.

China’s $6 trillion stock market rout reveals a painful truth for President Xi Jinping’s government: People are hopelessly gloomy about the outlook for the world’s second-largest economy, and their pessimism is becoming increasingly hard to ignore.

This month’s heavy selloff in China’s benchmark CSI 300 Index brings its plunge to a brutal 40% over the past three years, deepening anguish in a market dominated by mom-and-pop investors. A government rescue package under consideration backed by about 2 trillion yuan ($280 billion), first reported by Bloomberg News, and a sudden bank reserve ratio cut show that authorities are growing anxious to stem the rout.

But international and retail investors alike remain skeptical that these measures will be enough to prompt a sustained bounceback.

Compared to the country’s yearslong property crisis and demographic challenges, a stock market wipeout might look like a relatively superficial problem. Equities represent a fraction of the household wealth that real estate does, and there are no signs of systemic risk that might endanger financial stability.

But in a country where government control of financial commentary and economic data is tightening, markets provide a very public reminder of the problems that dog the real economy, from slumping house prices to rising trade tensions. The selloff risks damping consumer spending and business investment, making the economy’s troubles even worse.

China Stocks Are in a Tailspin

The CSI 300 Index keeps sliding despite interventions

Source: Bloomberg

“Repeating the mantra that the Chinese economy is on track can only do so much to make it happen,” said Frank Tsai, adjunct professor of international studies at Xi’an Jiaotong-Liverpool University in Suzhou, eastern China.

“Xi Jinping should be concerned with whether party perceptions are in line with the perceptions of Chinese and global investors.”

It’s almost a decade since China’s authorities last showed this much concern over the country’s stock market. But the economic backdrop of 2015 was very different.

At that time, the government was also prepared to inject massive stimulus into the economy’s main driver, real estate. It provided over 3 trillion yuan of central bank money for the demolition of old apartment buildings and the construction and sale of new ones. Authorities cut interest rates steeply, spurring consumer spending and business investment. The two-child policy was introduced that October, reinvigorating investor interest in the country. And official data put GDP growth for the year at 7%.

In 2023, the economy met its annual growth target of about 5% — but it also recorded its worst deflationary streak since the Asian Financial Crisis. Home prices fell the most in December in nearly nine years. Exports have struggled, the population is shrinking and there’s a vast army of jobless graduates.

More importantly, while authorities appear willing to intervene to support the market, they have clearly indicated a shift away from using debt-fueled stimulus to drive growth in the property sector and the broader economy. Policy measures have been modest, national security is becoming a priority on a par with growth, and signs that power is increasingly concentrated at the top of the Communist Party suggest government officials may struggle to respond to crises quickly.

China’s policy shift has led to a “withdrawal of credit from the market” because so much lending is tied to real estate, said Jason Hsu, chief investment officer at Rayliant Global Advisors Ltd. That means the scale of the current downturn is far larger than in 2015, he added.

“It has a negative wealth impact across the board that leads to deflating confidence — pessimism about the future at a much broader base,” he said.

China's Consumption Slump

Consumer spending is recovering much more slowly than production

Source: NBS, Bloomberg Economics

December 2019 = 100

With sentiment at its lowest ebb in decades, debate is growing over whether China’s economy will ever overtake the American one, or whether it is instead heading into the kind of stagnation that took hold in Japan in the 1990s.

Those questions are getting harder to answer. Beijing has ramped up restrictions on sensitive or unflattering information about the nation’s faltering economy. Official property market statistics paint a rosier picture than the reality, and conditions vary among cities and districts. Equity market data provides a window into what’s going on that’s more difficult to manipulate — even if the link between Chinese shares and long-term economic performance is tenuous at best.

China’s slump has arrived at a time when the S&P 500 has soared to fresh records and Japan’s Nikkei 225 has reached a 34-year high.

“The stock market decline over the past year is clearly a judgment of the Chinese economy,” said Christopher Beddor, deputy China research director at Gavekal Dragonomics based in Hong Kong. “Chinese stock markets tend to rally when nominal economic growth accelerates, and both Chinese and foreign investors have concluded that’s not likely to happen for now.”

Perhaps no one better personifies the market’s agony in recent months than Hu Xijin. The former editor-in-chief of the nationalist tabloid Global Times and prominent influencer drew public attention last year when he opened a local stock trading account with an initial investment of 100,000 yuan ($14,000). Since then, Hu says he has lost more than 70,000 yuan. His daily commentaries on the market have become a hot topic on social media platform Weibo, where netizens — including Hu — moan about their losses.

“Retail investors who refuse to take losses and leave the market are people that have shown their confidence toward the future of the economy,” Hu wrote in a Weibo post on Tuesday.

“The country should pay more attention to protecting this group and give investors the rewards they deserve.”

More Than $6 Trillion Lost Since Peak

Combined value of China and Hong Kong stocks drops back to 2020 levels

Source: Bloomberg

The combined market capitalization is calculated from all shares outstanding in the Chinese and Hong Kong equity markets. It does not include ETFs and ADRs.

Signs of urgency are growing among Chinese authorities, with Premier Li Qiang calling for “forceful” actions to stabilize markets earlier this week.

The $280 billion market rescue package under consideration and the announced RRR cut may help to put a floor under the current crisis. In 2015, authorities allowed China Securities Finance Corp., the main stabilization vehicle, to access as much as 3 trillion yuan of borrowed funds to buy stocks directly. The purchases kept the market range-bound, and prices only started to recover in mid-2016 when the economy began to improve.

But this time around, investors say they need to see more concrete actions from Beijing to prop up growth as well as policy shifts to drive a sustained rebound in the market.

Beijing will need to deliver the macroeconomic stimulus it has signaled — particularly increased government borrowing and spending, which will help boost domestic demand. Details won’t be unveiled until the annual legislative sessions in early March, when the government issues its work report. The central bank will need to make borrowing easier via cuts to interest rates and the RRR.

Investors are also looking for efforts to stem the worsening property downturn. Further measures will likely be required to address developers’ financing troubles and unfinished apartment projects. Central bank-backed money to support construction projects is highly anticipated.

A series of government campaigns aimed at everything from environmental protection to narrowing the wealth gap has dealt a significant blow to businesses in recent years. Improving the landscape for private companies — including better protection of property rights — and policies to allow more market forces in allocating resources will be key to easing distrust among private entrepreneurs.

In addition, investors want China to reduce trade tensions and improve relations with other major economies, including the US.

“The road to regaining confidence and achieving a sustained stock market rebound will likely be gradual and require consistent efforts from the Chinese authorities,” said Manish Bhargava, a fund manager at Straits Investment Holdings in Singapore.

China's Consumers Are Still in the Dumps

Confidence has yet to recover from 2022 lockdown stress

Source: China National Bureau of Statistics

So far there’s no clear indication that Beijing will make any of these changes. China’s top leaders have stressed the need to promote a more sustainable growth model and avoid repeating the mistakes of previous downturns, when massive stimulus boosted short-term growth but left the economy with a huge debt burden. Still, some investors hope that the dire state of the economy will spark a change of direction.

“Xi has shown that he can act quickly when circumstances require quick action — recall the sudden end of the Covid lockdowns. If he chooses to do so, he can turn things around,” said Belita Ong, chairman at Dalton Investments LLC.

Stock investors have learned that policymakers may not share their perspective on the economy.

At a recent meeting, People’s Bank of China Deputy Governor Lu Lei was asked if he was an investor and whether he could identify with those who had suffered during the market rout. Lu called it a tough but “fair” question, according to a person with knowledge of the matter who declined to be named.

Li Bei, founder of Shanghai Banxia Investment Management Center, said that divergent views may be partly because authorities prioritize real economic growth figures that are adjusted for price changes, while markets care more about nominal expansion, which has been slower due to deflation.

With fewer levers to pull and a skeptical investor base to win over, a sustained turnaround will be a tall order for Beijing.

“The situation is much harder than 2015,” said Alicia Garcia Herrero, chief Asia-Pacific economist at Natixis SA. “They need to come up with a big stimulus. I don’t know whether they have the fiscal space or even if they can cut rates enough to make it happen.”

“So, brace,” she said. “We should tighten our seatbelts.”

— With assistance from Colum Murphy, Charlotte Yang, John Cheng, and Emily Cadman

The $9 Billion Chip Plant Stuck in Limbo of US-China Rivalry

Recent concessions still leave murky future for SK Hynix and Samsung plants in China

A memory chip plant located halfway between Seoul and Beijing illustrates the tough choices South Korean business leaders and policymakers face as they try to limit the damage from the US technology war with China.

South Korean chipmaker SK Hynix Inc. bought its Dalian plant in northeast China from Intel Corp. in a $9 billion deal in 2020 that was supposed to help the world's No. 2 memory maker shore up capacity and expand into cutting-edge chips in the world's largest chip market. Instead, the factory has ensnared SK Hynix in a complex web of US restrictions aimed at limiting China’s access to materials and equipment considered key to dominating the battlegrounds and industries of the future.

In the years since the deal closed, SK Hynix has remained in limbo, unable to commit to big capex plans at the factory. The company had quickly built a shell for a new fab at the back of site, but it remains unclear if it contains any equipment to produce chips at all, let alone the advanced semiconductors that might secure solid returns on its hefty investment. Intel’s logo still sits atop the gleaming marine-blue glass façade of the factory complex, with the final payment for the plant due in 2025.

The company appeared to find a solution to its predicament in the fall after the US gave SK Hynix and Samsung Electronics Co. indefinite waivers to keep bringing some high-end equipment into China.

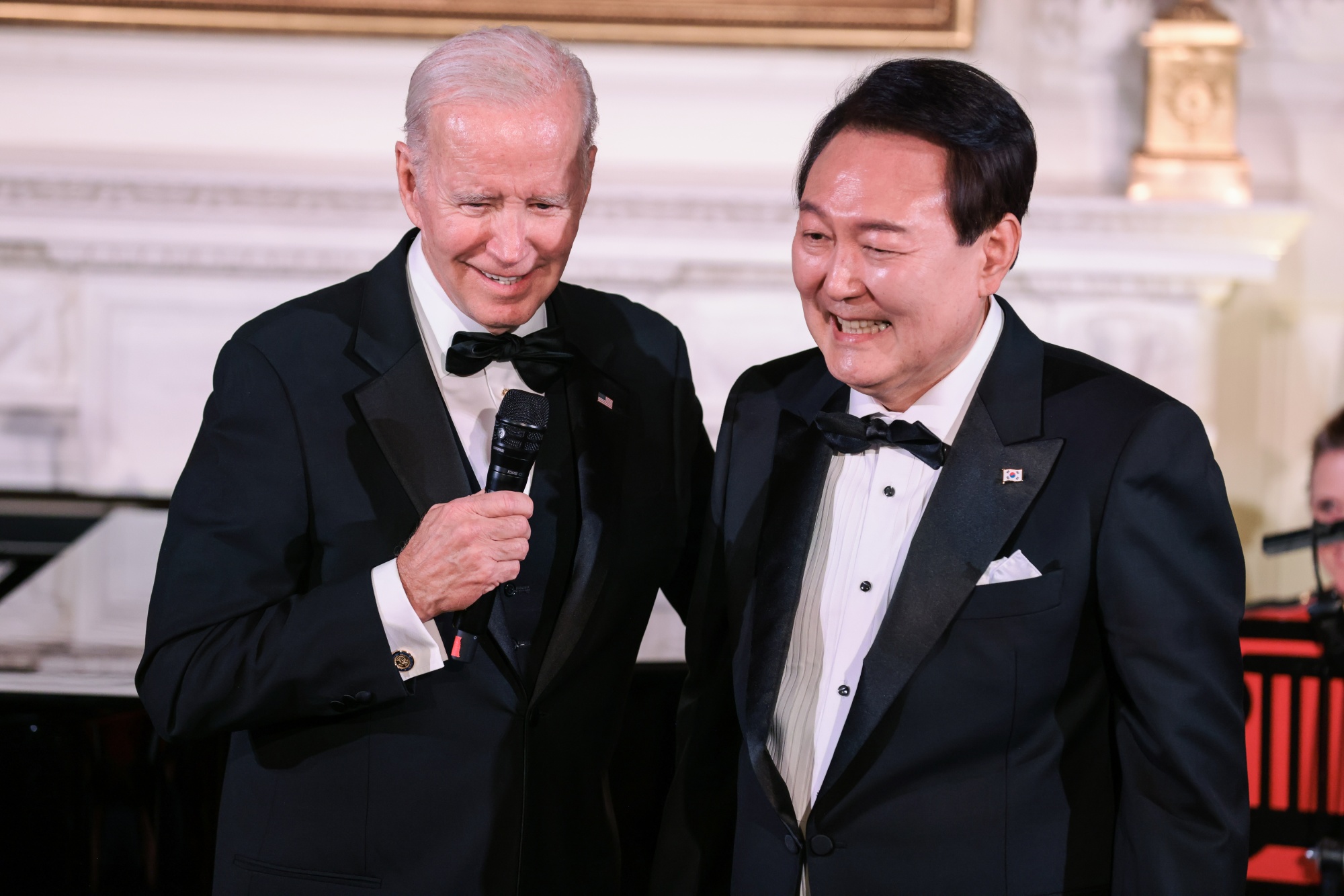

South Korea’s government has attributed those concessions in part to President Yoon Suk Yeol’s charm offensive during his meeting with US President Joe Biden, aided by promises of investment and a surprise rendition of “American Pie.” The US side was also likely swayed by the need to keep major tech firms supplied with chips.

But there’s no guarantee those waivers will stay in place, especially if Republican frontrunner Donald Trump wins November’s US presidential election and returns to the White House.

“The SK Hynix plant in Dalian captures the difficult position South Korea chipmakers are in as a result of US restrictions,” said Masahiro Wakasugi at Bloomberg Intelligence. “Even with the latest US concessions it still probably doesn’t make sense for SK Hynix to expand capacity in Dalian given uncertainty over the US presidential election and US policy after that.”

South Korea’s economy is heavily reliant on the semiconductor sector to drive growth. That makes it especially vulnerable to Washington's drive to cut supply chain dependence on China and constrain Beijing’s access to key chip technology. The International Monetary Fund has warned that South Korea would be the largest potential loser in the Asia-Pacific region if the two superpowers' economies were to decouple.

“Korea needs to walk a delicate tightrope in balancing its relations with the United States and China,” said Troy Stangarone, senior director at the Korea Economic Institute. “It is at the forefront of critical technologies related to semiconductors and EV batteries that create economic opportunities, but also vulnerabilities for Korean firms.”

The SK Hynix factory in Dalian specializes in 3D NAND flash memory used in smartphones and other devices. NAND accounts for an increasing portion of the company’s revenue, around 27% of which comes from China. Including DRAM, South Korea has a combined global memory chip share of more than 60%.

The existing legacy output at the Dalian plant largely falls outside the US restrictions on advanced technology, but SK Hynix was likely looking beyond those parameters for the new fab to ensure its competitiveness over the longer-haul, according to BI’s Wakasugi.

The waivers from the US government allow SK Hynix and rival Samsung Electronics Co. to import US chip equipment while still leaving limits on the most advanced dual-use technology, although companies that receive Chips Act subsidies are barred from expanding advanced chip-making in China by more than 5% over 10 years.

The option of cutting losses and selling the plant would likely require US government approval and Washington is unlikely to green light the sale to a Chinese bidder.

The waiver "considerably lowered" the risks surrounding SK Hynix's operations in China, SK Hynix Chief Executive Officer Kwak Noh-jung said earlier this month at a press briefing. The company separately declined to comment on the implications of a possible Trump presidency and denied rumors it was looking to sell.

“We are not considering selling our fabs in Dalian at all,” it said in a statement. “SK Hynix will maintain its China operations, while abiding by regulations and laws in the jurisdictions in which it does business and will do its part for the development of the semiconductor industry.”

Diplomatic Drive

From the moment the Commerce Department released its restrictions on use of advanced US chip technology just over a year ago, South Korean policymakers worked around the clock to negotiate with their US colleagues to try and hone their impact.

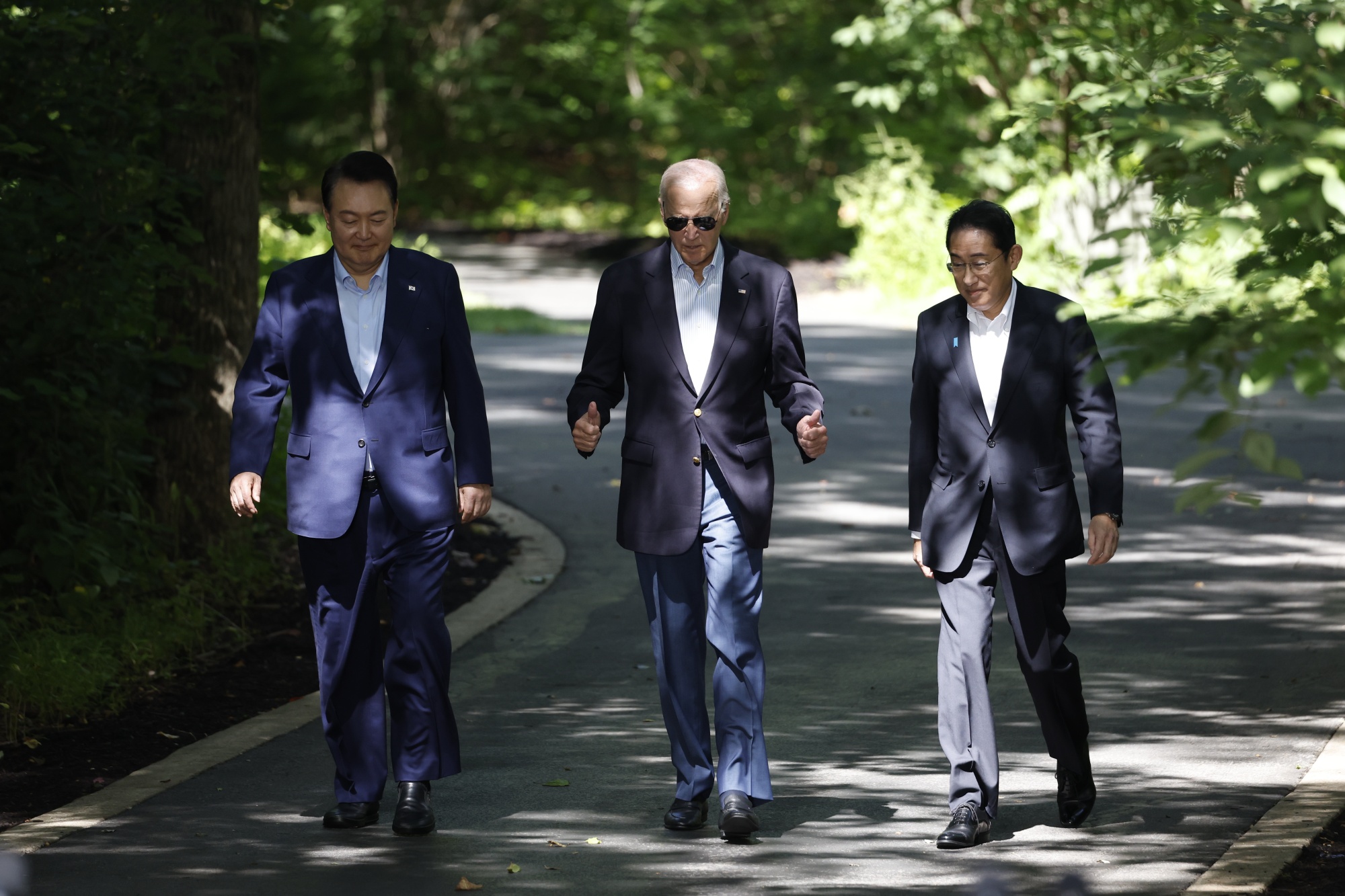

President Yoon led the way with highly visible efforts to strengthen ties with Washington and repair relations with a shared US ally: Japan. A summit meeting with Biden in April was followed by a three-way Camp David meeting with Japanese Prime Minister Fumio Kishida in August.

For their part, SK Hynix and Samsung bumped up spending on lobbyists in the US as they tried to get their concerns reflected in Washington while also communicating closely with South Korea’s trade ministry.

South Korean Trade and Industry Minister Ahn Duk-geun views Yoon’s efforts as a game-changer that “substantially alleviated” the situation for chipmakers in China, laying the groundwork for Korean officials to convince US authorities that Hynix products from Dalian were innocuous.

But even with the “exceptional arrangement,” Ahn acknowledges that the outlook isn’t entirely clear for Korean chipmakers and other trade-reliant businesses.

“Depending on unexpected geopolitical risk, you never know what kind of policy will come, right?” he said. “We still have a huge political risk in the coming years, not just in the US. Many countries are now waiting for new results of elections. So we do have many new political risks and, as a government, that is a big challenge.”

Apple Supplies

The decision to grant waivers for Samsung and SK Hynix to bring US equipment into China reflects the need to keep a steady stream of chips flowing to major US companies including Apple Inc., Microsoft Corp. and Google parent Alphabet Inc.

Apple gets almost 20% of its revenue from China and is SK Hynix’s largest customer, according to Bloomberg supply chain analysis. The iPhone maker is also the biggest consumer of Samsung’s components even though the Korean company’s Galaxy phones are its biggest competitor.

On that basis alone continuing access to output from Korean factories in China remains crucial to the supply chain for many of Apple’s products.

But Washington maintains leverage over its ally as a guarantor of South Korea’s security and its largest trading partner after China. The US also has influence through its control of chip manufacturing knowhow and through the Chips and Science Act, which offers $100 billion in funds to firms building plants on American soil.

Although neither firm has received any subsidies yet, SK Hynix has said it will invest $15 billion in a chip-packaging plant in the US, and Samsung, the world’s biggest memory chipmaker, has applied for money from the US for its planned plant in Taylor, Texas.

The US is the dominant player in half of 10 key chipmaking stages singled out by Bloomberg Intelligence including etching, plasma deposition and sputtering, with Japan and the Netherlands controlling the rest including wafer cleaning and lithography. That means South Korea’s key role as a chip manufacturer is dependent on technology, materials and expertise provided mainly by the US and its allies. To ensure they stay at the forefront of the chip sector, South Korean chipmakers need the collaboration of US firms, not Chinese companies.

China’s Grip

South Korea has already seen what can happen when the US and China fight, with the nation’s economy collateral damage in a dispute almost a decade ago.

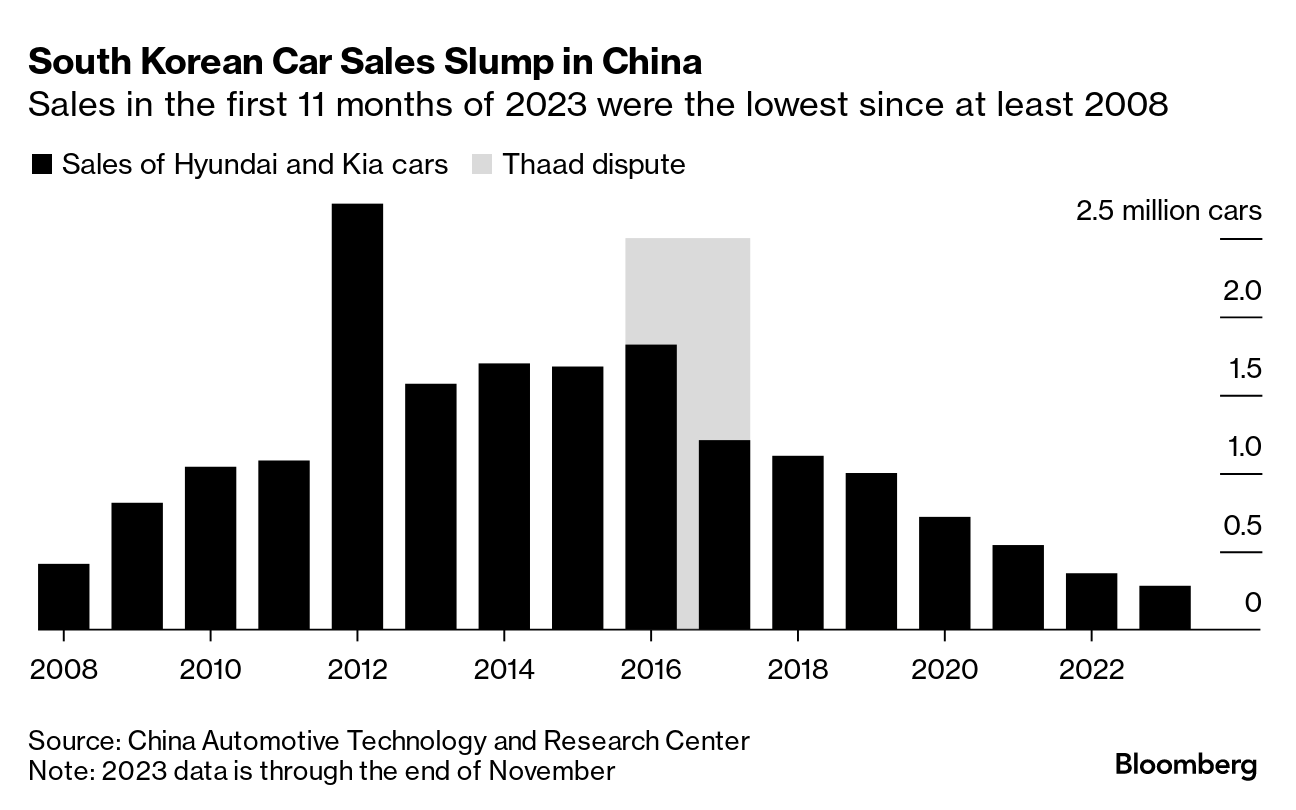

A decision in 2016 to allow the US to deploy a ballistic missile system in South Korea sparked a furious reaction from Beijing, which punished South Korean firms in China and squeezed the flow of Chinese tourists as it tried to force Seoul to change its mind. The Chinese actions damaged economic growth, inflicted billions of dollars of losses on the Lotte conglomerate and triggered a slump in car sales from which Hyundai Motor Co. and Kia Corp. never recovered.

China’s recent controls on graphite exports are another example of the country getting caught up in bigger geopolitical issues. While the actions was more likely a retaliation against US chip rules, the material is a key element needed by South Korea’s up-and-coming battery makers and is a reminder of the crosswinds buffeting Seoul from competition between its two largest trading partners.

Whether to stay or go is the biggest concern among Korean companies running businesses in China, according to Ryu Jin, chairman of the Federation of Korean Industries. “The relationship with China is so important, so that’s why they are still contemplating what to do,” Jin said at a press conference in Seoul in late December.

China’s ascent up the value chain presents another cause for concern. Chinese smartphones and cars now outcompete South Korean equivalents, and that prompted a major withdrawal of Korean production in China, especially after the experience of the Thaad dispute. The experience of getting competed out of the market offers a glimpse of what the future might have in store for Korea’s chipmakers if they try to push ahead with advanced technology in China.

As some South Korean businesses reorient themselves away from the world’s second-largest economy, trade data shows a trend toward the US.

While China is still by far South Korea’s biggest trading partner, monthly exports to the US surpassed those to China for the first time in more than two decades in data released at the beginning of 2024.

That’s another indication that while South Korea is trying to keep its options in both China and the US as open as possible, it is already leaning more in the direction of the US as policymakers and firms change strategies to deal with a technology battle that is reshaping trade, supply lines and alliances across the globe.

“Korea’s companies will need to make some tough decisions as it weighs the risks, pressures and opportunities emanating from both the United States and China,” said Wendy Cutler, vice president of the Asia Society Policy Institute, who once led US trade talks with Seoul.

“Even with these waivers, in many respects the handwriting is on the wall.”

-- James Mayger and Sam Kim contributed to this article.

— With assistance from Sam Kim, James Mayger, Mackenzie Hawkins, Ian King, Heejin Kim, and Shery Ahn

No comments:

Post a Comment