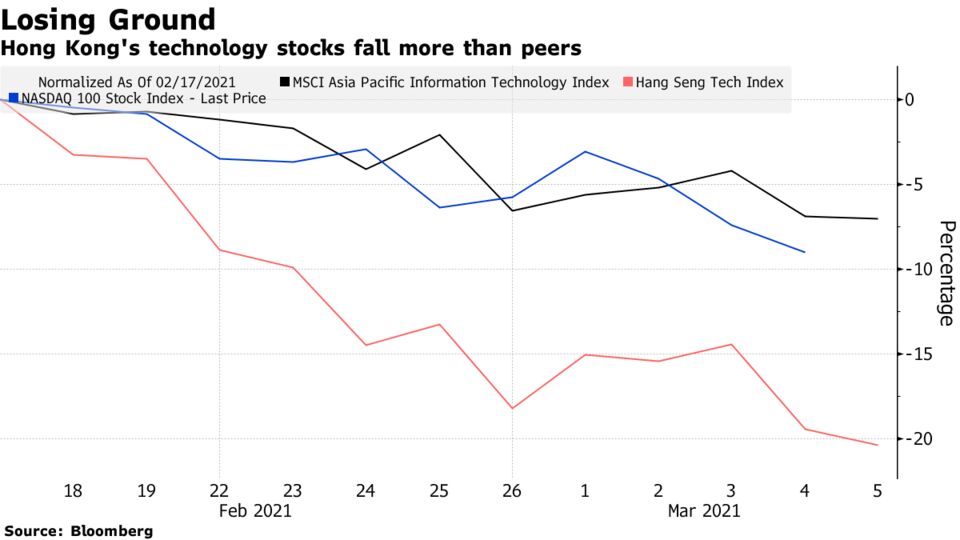

Chinese Tech Index Drops 21% in Two Weeks on Yield Concerns

- Hang Seng Tech Index declines from peak recorded Feb. 17

- Rout comes on global tech selloff in U.S., Asian markets

Follow Bloomberg on Telegram for all the investment news and analysis you need.

Chinese technology stocks have fallen 21% in just over two weeks as higher borrowing costs deepen concerns over valuations.

The Hang Seng Tech Index, which includes Chinese technology giants Alibaba Group Holding Ltd. and Tencent Holdings Ltd., closed down 2.1% Friday. The gauge has steadily declined since its Feb. 17 peak, compared to a drop of 9% in the Nasdaq 100 and a decline of around 7.5% in the MSCI Asia Pacific Information Technology Index over that time.

The latest bout of selling followed a fresh spike in Treasury yields overnight. The technology sector is particularly sensitive to concerns that highly valued stocks may struggle to match expectations if borrowing costs surge, as Covid lockdowns end and economic growth fuels cyclical shares. The recent rout in the Hong Kong gauge comes after the Nasdaq 100 narrowly avoided a correction, typically defined as a 10% drop from a peak, as investors scale back bets.

“The biggest concern now is the unstoppable increase of bond yields in the short term,” said Castor Pang, head of research at Core Pacific-Yamaichi International Hong Kong Ltd. “Technology firms are not typically cash rich companies and have high leverage, so they are in particular sensitive to rising yield.”

Tech giants listed in Hong Kong had been the target of heavy buying interest from mainland traders at the start of the year, with record levels of money flowing via trading links helping push the Hang Seng Index past the 30,000 point level for the first time since May 2019. But those flows have decreased, with recent trading days seeing some net selling, according to data compiled by Bloomberg.

No comments:

Post a Comment