Plenty of liquidity.. hahaha

Huarong Bonds Drop After Report Regulators Consider Restructuring

By and- Several options being considered for offshore unit, Reorg says

- Regulators said last week China Huarong was operating normally

A pedestrian walks past the China Huarong Tower in Hong Kong.

Photographer: Lam Yik/BloombergChina Huarong Asset Management Co.’s dollar bonds sank Tuesday after Reorg Research reported regulators are considering options for the company that include restructuring the debt of its offshore unit.

A debt restructuring is one of several options under discussion and a decision is far from finalized, according to the report, which cited people familiar with the matter. Reorg is a New York-based provider of credit data and analytics. Almost all of China Huarong’s $22 billion in dollar bonds are issued or guaranteed by China Huarong International Holdings Ltd., the offshore unit.

A representative for Huarong couldn’t immediately be reached for comment when contacted by Bloomberg.

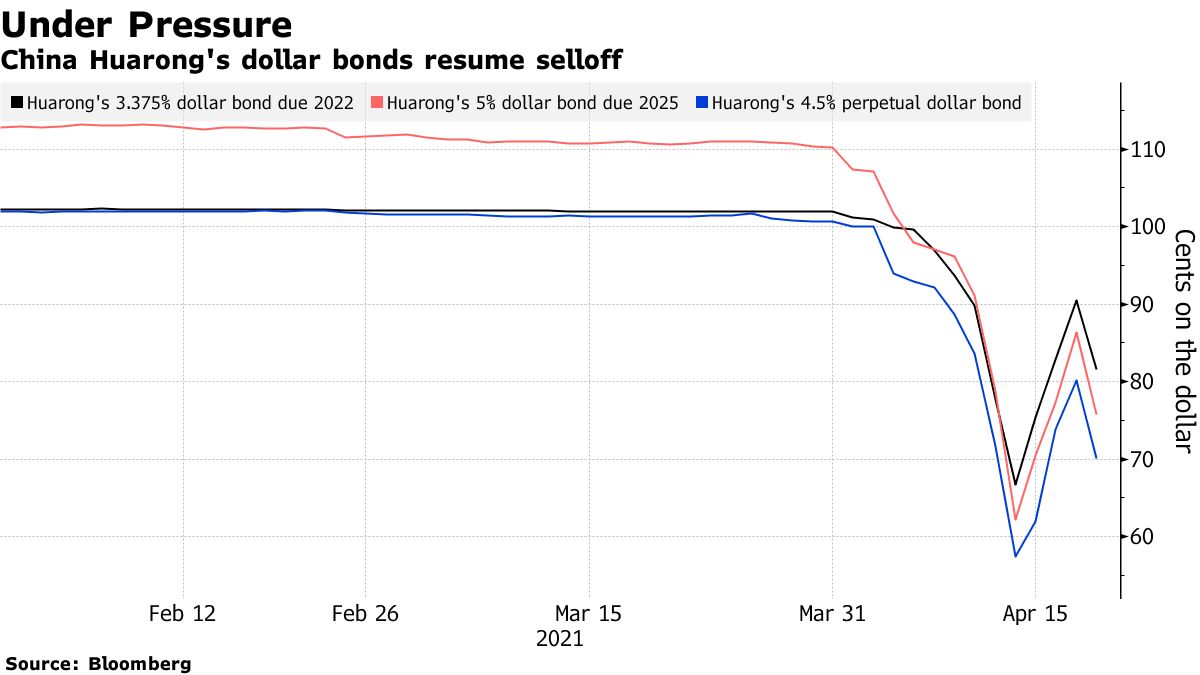

The company’s 5.5% bond maturing in 2025 fell 12.3 cents to 75.1 cents on the dollar, Bloomberg-compiled prices show. A 4.5% perpetual note slumped 9.7 cents to 69.3 cents.

The declines follow a three-day rally in the firm’s dollar bonds that accelerated Friday after China’s financial regulator said that the bad-debt manager was operating normally and had ample liquidity. The statement, made after a regular briefing in Beijing, were the first official comments since the company jolted Asian credit markets by missing a deadline to report preliminary earnings on March 31.

“There’s very little clarity from China Huarong and regulators over the fate of offshore investors so the bonds are still vulnerable to big swings,” said Owen Gallimore, head of credit strategy at Australia & New Zealand Banking Group in Singapore.

A potential restructuring or default for China Huarong would be the nation’s most consequential since the late 1990s. Any signs that Beijing is rethinking its support for a central, state-owned firm like China Huarong would have deep repercussions for the broader dollar bond market. The company is majority owned by China’s Ministry of Finance and is deeply intertwined with the nation’s $54 trillion financial industry.

No comments:

Post a Comment