BofA Warns U.S. Policy Is Fueling a Bubble in Wall Street Prices

- Strategists note risk of taper tantrum, volatility events

- BofA forecasts a market correction in the first quarter

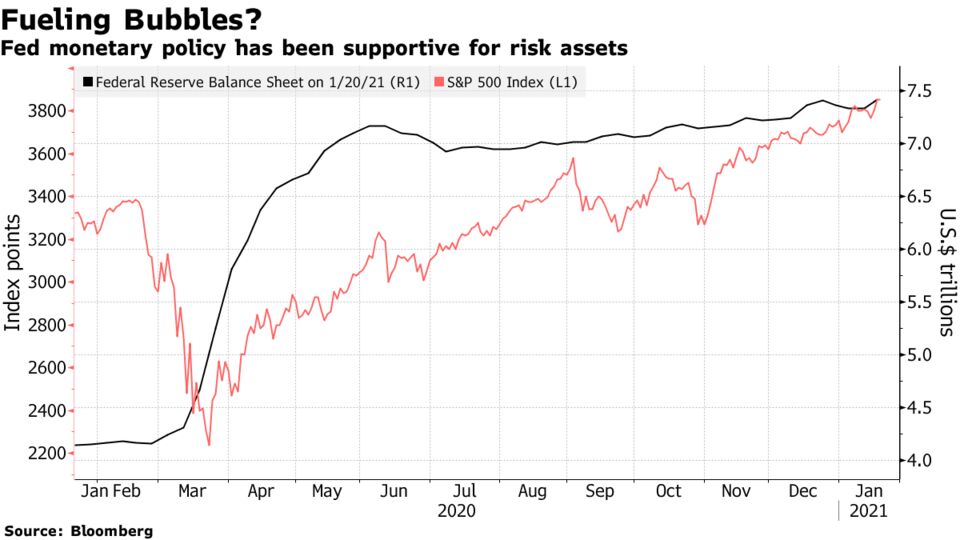

Bank of America Corp. strategists warned the “extreme rally” on Wall Street that has pushed stocks to record highs, fueled by strong U.S. policy stimulus, is forming a bubble in asset prices.

“D.C.’s policy bubble is fueling Wall St’s asset price bubble,” strategists led by Michael Hartnett wrote in a note on Friday. “When those who want to stay rich start acting like those who want to get rich, it suggests a late-stage speculative blow-off.”

The strategists predict a market correction and for positioning to peak in the first quarter, with the BofA Bull & Bear Indicator closing in on a “sell signal.”

Soaring market prices as investors boost inflation-linked trades will drag “Main St inflation” higher, risking a taper tantrum, tighter financial conditions and volatility events, the strategists warned. They highlighted past bubbles including that of the dot-com era and the housing market in 2007-2008.

Risk assets rallying on vaccine prospects are getting fresh impetus this year from bets that a win for U.S. Democrats in the Senate will spur further fiscal stimulus, adding to Federal Reserve largesse. The S&P 500 Index has surged more than 70% since its low last March, while the Nasdaq 100 has almost doubled and Bitcoin has soared above $30,000.

Central-bank balance sheets have ballooned in 2020, growing to a record size for the Fed and the European Central Bank. BofA expects the Fed balance sheet to reach 42% of U.S gross domestic product this year, while predicting the country’s budget deficit will hit 33% of GDP.

No comments:

Post a Comment