Bubble Watch Enters Year 12

Even when you understand the science behind them, some natural phenomena just never cease to amaze: the Northern Lights, moon haloes, Paul Rudd’s immunity to aging.

The resilience of the stock market is another one. Global pandemic? Buy stocks. Vaccine for that pandemic? Buy stocks. Big job gains? Buy stocks. Big job losses? Buy stocks. That last bit happened just today: The Labor Department reported the economy shed 140,000 jobs last month, far short of expected small gains. Not great! But, of course, stocks rose, because that is what they must do.

And the rationale du jour is pretty obvious, writes Brian Chappatta: Job losses mean more stimulus, which is even more likely now that Democrats will soon control all of Congress. West Virginia Democrat Joe Manchin briefly rained on this trade when he said he wouldn’t back the $2,000 stimulus checks President-elect Joe Biden promised to close the deal in Georgia runoff elections. But Manchin quickly backtracked, and the stock-buying resumed, as it probably would have anyway.

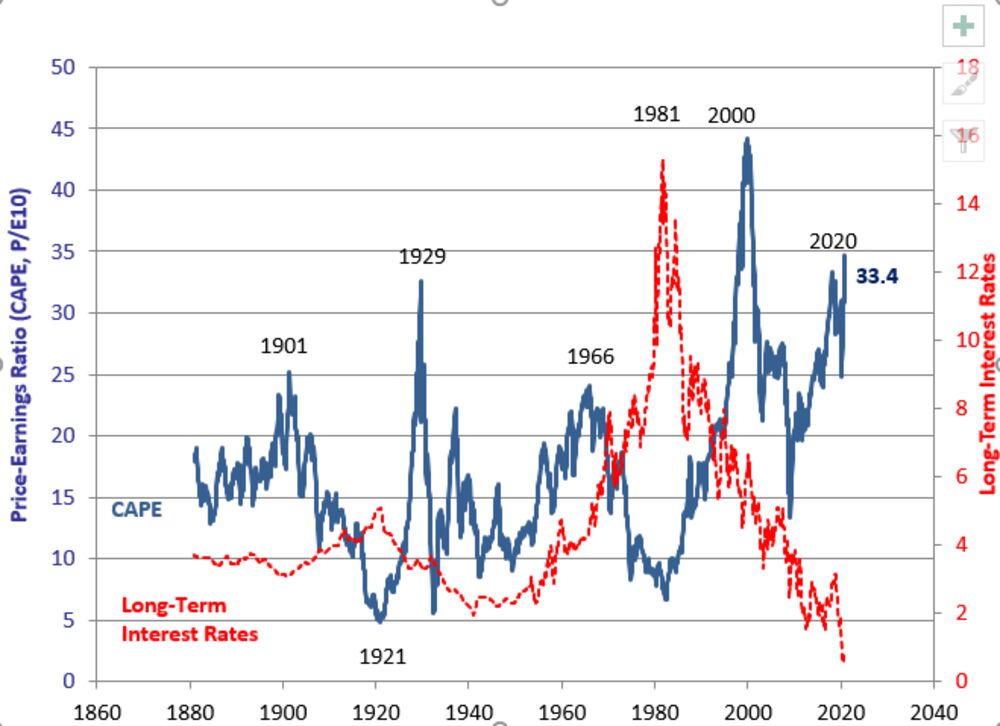

We all know the reasons stocks never stop rising: the Fed, ETFs, Paul Rudd’s face. What we don’t know is how this will end. It has to end sometime, right? And not just because it always does. John Authers lays out the evidence we are in the “fog a mirror, buy a house” phase of another market bubble. Most striking is this chart of cyclically adjusted price to earnings:

The eagle-eyed, Paul Rudd-like readers of this newsletter will observe that the “different this time” part of that chart is the red line, which tracks long-term interest rates. They have spent the past year drilling toward the Earth’s core, mining fuel for the blue line above. But what, John wonders, will happen to stocks when rates reverse? And will it be Biden’s supersized stimulus, ironically, that makes that happen?

No comments:

Post a Comment