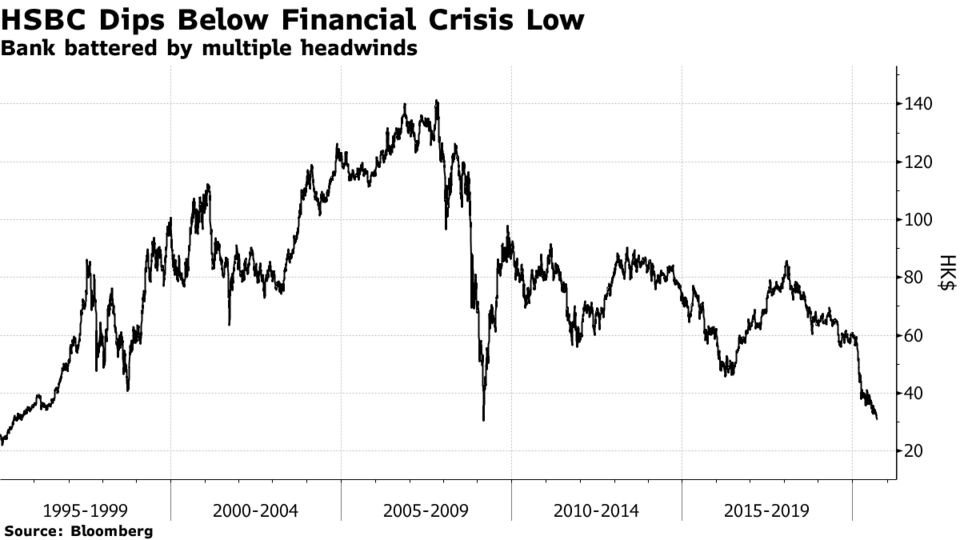

HSBC Shares Decline to Lowest Since 1995 in Hong Kong

- Europe’s largest bank pressured by turmoil on several fronts

- Lender’s shares have lost half their value this year

HSBC Holdings Plc slumped below its financial crisis low set more than a decade ago as pressures mount on several fronts, including political tension in Hong Kong, the fallout of the pandemic and renewed Brexit turmoil in the U.K.

The London-based bank’s Hong Kong shares on Monday slid below their closing low for March 2009, hitting HK$30.25 as of 9:20 a.m. local time, as they extended this year’s plunge to 50%. Echoing a decline in London on Friday, its Hong Kong shares are trading at the lowest since 1995.

Europe’s largest bank has been caught in a swirl of trouble over the past year amid political unrest and economic turmoil in its biggest market, Hong Kong. It also faces difficulties in navigating low interest rates and surging loan losses sparked by the global pandemic.

HSBC was also named among global banks by the International Consortium of Investigative Journalists that “kept profiting from powerful and dangerous players” in the past two decades even after the U.S. imposed penalties on these financial institutions.

HSBC Chief Executive Officer Noel Quinn, who took over as the bank’s permanent head in March, last month issued a stark warning about tough times ahead while reporting that first-half profit halved and predicting loan losses could swell to $13 billion this year. Quinn said the bank would attempt to hasten a shakeup of its global operations, accelerating a further pivot into Asia as its European operations lose money.

Struggling to boost returns, the lender has come under fire both in the West and in China as it attempts to steer through political tension. HSBC was lambasted in the U.S. and the U.K. over its support for China’s new security legislation on Hong Kong, while state-backed Chinese media has voiced displeasure over the lender’s role in an American investigation of Huawei Technologies Co.

A jump in income from its markets business has failed to make up for broader shortcomings, unlike at some Wall Street and European competitors. HSBC stock has fallen more steeply than most big rivals this year, with Citigroup Inc. and JPMorgan Chase & Co. posting declines of 44% and 29%, respectively.

To make matters worse, HSBC sparked anger in Hong Kong earlier this year, alienating some of its most loyal investors, after scrapping its dividend in response to the pandemic. The bank is the worst performer on the benchmark Hang Seng index so far this year.

No comments:

Post a Comment