China’s pork reserves running out as prices soar, analysts say

Be the first to know about every new Coronavirus story

China has nearly exhausted its reserves of frozen pork, according to new estimates that underscore the supply shortfall in the world’s top protein market two years after the arrival of African swine fever.

The level of reserves is a state secret in China, the world’s number one producer, consumer and importer of pork. But Enodo Economics, a London-based consultancy focused on China, estimates that reserves fell by about 452,000 tonnes between September 2019 and August this year.

China has less than 100,000 tonnes of pork reserves remaining, says Diana Choyleva, Enodo’s chief economist. “At this rate, within two to three months they’ll be out,” she added.

The numbers back up comments from the US agricultural attaché in Beijing in a recent livestock report on China, which noted that “pork reserves appear to have been mostly depleted by the third quarter of 2020”.

The country reported its first case of African swine fever in 2018. Since then, more than 100m pigs have been lost, pushing pork prices up to record highs. In response, China has sold frozen meat from its reserves into the domestic market to try and restrain prices.

Despite inching down from their highs, spot wholesale prices are still more than double their pre-swine fever levels at Rmb47.61 ($7) per kilogramme. The cost of pork to consumers rose more than 50 per cent in August from a year earlier, according to official data.

The pork reserves act to stabilise high prices rather than to provide a replacement for tight supplies. The decline in reserves means that Beijing’s “ability to directly intervene in the pork market will be more limited in the second half of 2020 and into 2021”, warned the USDA report.

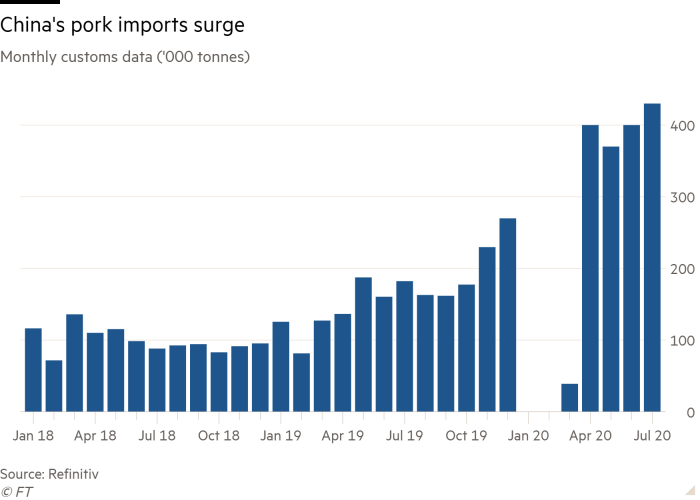

The shortage has forced China to import record amounts of the meat this year from top producers including the US, despite President Xi Jinping’s push for greater agricultural self-sufficiency. Pork imports hit 430,000 tonnes in July, more than doubling from a year before.

“China’s demand is at record levels this year. It is the kingmaker in the global animal meat trade,” said Justin Sherrard, global strategist for animal protein at Rabobank.

The country is the world’s largest meat consumer. Over the past five years, China’s average annual demand for pork has been about 50m tonnes, according to USDA data.

Darin Friedrichs, an analyst at commodities broker StoneX in Shanghai, said it was likely that the surge in imports rather than the depletion of China’s reserves was “going to have a much bigger impact” on pork prices. Sales from Beijing’s reserves were “more about showing they are doing something”, he added.

Chinese farmers, enticed by high pork prices, have returned in droves to raising hogs despite reports of continued outbreaks of the virus, which is deadly to pigs but harmless to humans.

Piglet prices have also surged, pushing up imports of feed grains as farmers expand their herds. That has driven a rally in global feed markets, with soyabean futures in Chicago rising above $10 a bushel in September to the highest level in more than two years.

A greater reliance on imports is politically tricky for Beijing. When China resumed imports of Canadian meat late last year after a four-month hiatus, a foreign ministry official warned it was not a sign of thawing relations.

Last week, China banned pork imports from Germany, where swine fever had recently been discovered, to “protect the animal husbandry industry and prevent the spread of the disease”.

No comments:

Post a Comment